Paycheck tax calculator mn

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Employee Maintenance MN PS150S.

Dave Ramsey Allocated Spending Plan Worksheet How To Plan Dave Ramsey Budgeting

Use this calculator to find the general state and local sales tax rate for any location in Minnesota.

. The results are broken up into three sections. Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the 2022 tax year which means. All Services Backed by Tax Guarantee.

Minnesota tax year starts from July 01 the year before to June 30 the current year. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages. Leave Accounting MN PS350S.

Use this Minnesota gross pay calculator to gross up wages based on net pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Minnesota. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Minnesota Salary Paycheck Calculator. With the exception of the deduction for state and local income taxes all federal itemized deductions can also be claimed on Minnesota state income tax returns. Ad Get the Paycheck Tools your competitors are already using - Start Now.

Why Gusto Payroll and more Payroll. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Deduct and match any FICA taxes.

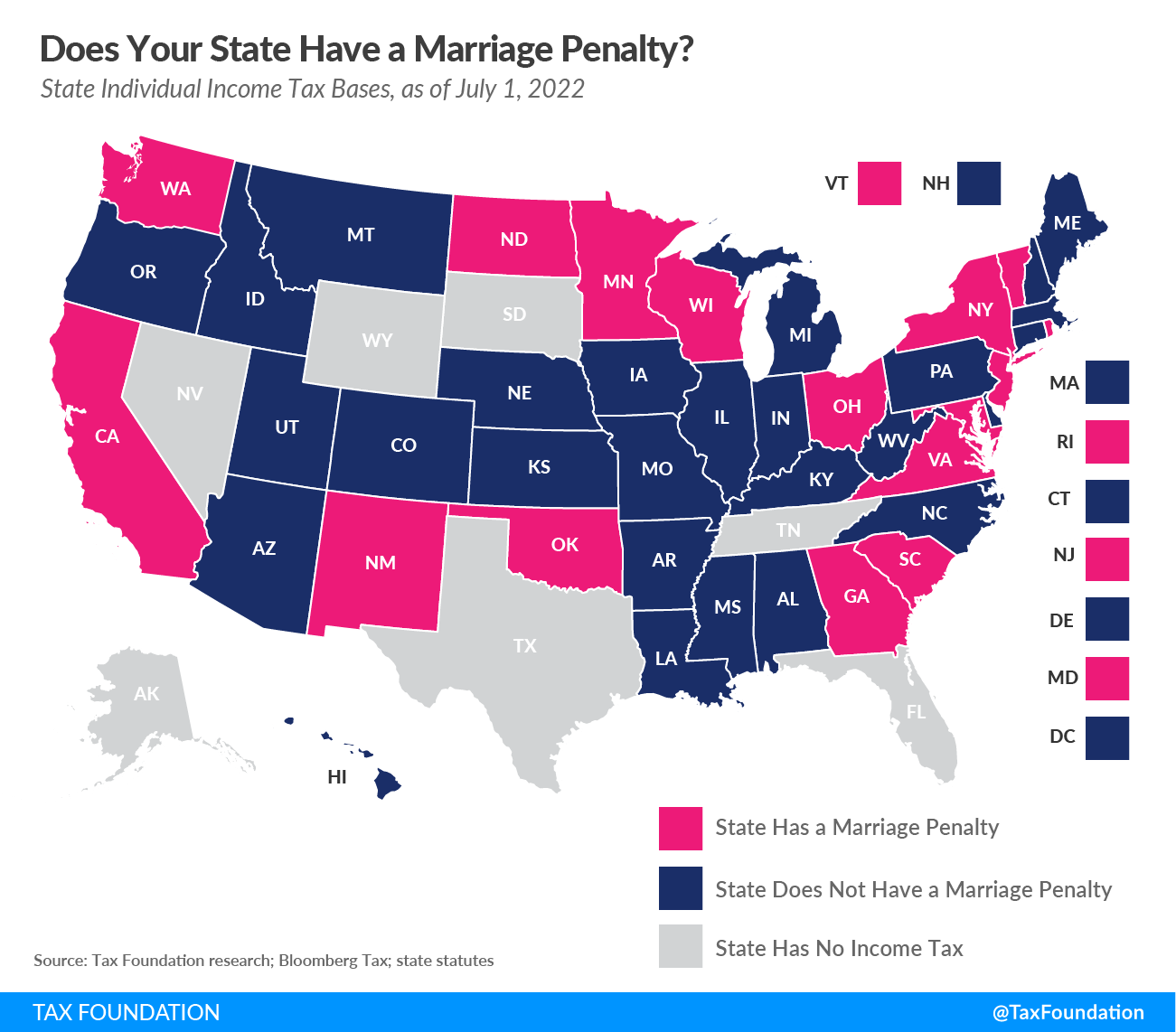

The results do not include special local taxessuch as. Like the Federal Income Tax Wisconsins income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Mass Time Entry and Labor Distribution MN PS320S.

Choose Your Paycheck Tools from the Premier Resource for Businesses. The MN Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Minnesota Hourly Paycheck Calculator Results. If you make 70000 a year living in the region of Minnesota USA you will be taxed 12899. Just enter the wages tax withholdings and other information required.

Minnesota Income Tax Calculator 2021. Sales Tax Rate Calculator. Calculate your Minnesota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

So the tax year 2022 will start from July 01 2021 to June 30 2022. You then send this money as deposits to the Minnesota Department. The Minnesota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Below are your Minnesota salary paycheck results. Why Gusto Payroll and more Payroll. Follow the steps below.

Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Minnesota. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Minnesota Hourly Paycheck Calculator. 2022 tax rates for federal state and. Paycheck Results is your gross pay.

The Minnesota tax calculator is updated for the 202223 tax year. For example if an employee receives 500 in take-home pay this calculator can be used to. Labor Relations MN PS180S.

Minnesota Income Tax Calculator Calculate your federal Minnesota income taxes Updated for 2022 tax year on Aug 31 2022. Your average tax rate is 1198 and your.

2022 Federal State Payroll Tax Rates For Employers

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

New York Tax Rates Rankings New York State Taxes Tax Foundation

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

5 Printable Pay Stub Templates In Word Format Printablepaystub Stubtemplates Pintablepaystub Word Template Words Templates

2022 Federal Payroll Tax Rates Abacus Payroll

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Dave Ramsey Monthly Budget Excel Spreadsheet Now If Only I Could Find A Way To Download It Budgeting Monthly Budget Excel Excel Budget

The Power Of Paycheck Planning Credit Org Springboard Nonprofit Learning Centers Budgeting Budgeting 101

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Minnesota Paycheck Calculator Smartasset

Free Llc Tax Calculator How To File Llc Taxes Embroker

2022 Federal State Payroll Tax Rates For Employers

Taxation Of Social Security Benefits Mn House Research

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Taxes On Forgiven Student Loans What To Know Student Loan Hero